How to Apply for Hustler Fund on Your Mobile Phone through USSD Code

Learn how to easily register for the Hustler Fund loan using a simple USSD code. Follow these steps to initiate the registration process and receive a confirmation message within hours.

The Hustler Fund is a fantastic opportunity for entrepreneurs and small business owners to access financial support for their ventures. To make the application process more convenient, the Hustler Fund has introduced a USSD code system, allowing you to apply directly from your mobile phone. In this article, we will guide you through the steps of applying for the Hustler Fund using the USSD code, making it easier than ever to access the financial resources you need.

Hustler Fund Loan Application Requirements: Eligibility Criteria

To ensure a successful loan application with the Hustler Fund, it’s important to meet the specified requirements. This article outlines the key eligibility criteria that applicants must fulfill before applying for a loan. By adhering to these requirements, you can enhance your chances of a smooth and successful loan application process.

- Possess a Valid Kenyan National ID Card: To be eligible for a loan with the Hustler Fund, applicants must possess a valid Kenyan National ID card. This serves as a crucial identification document and is essential for verifying your citizenship and residency.

- Be a Kenyan Citizen: The Hustler Fund is exclusively available to Kenyan citizens. Applicants must hold Kenyan citizenship to qualify for a loan. Ensure you meet this criterion before proceeding with your loan application.

- Be a Kenyan Resident: Residency in Kenya is another requirement for loan applicants. It is essential to provide proof of your residency within Kenya to be eligible for the Hustler Fund loan. This can be done by submitting relevant documentation during the application process.

- Have a Kenyan Mobile Phone Number and Mobile Money Account: Applicants should have a Kenyan mobile phone number registered with either Telkom, Airtel, or Safaricom. Additionally, access to a mobile money account such as T-Kash, Airtel Money, or M-PESA is required. These are vital for communication and the disbursement of loan funds.

- Accept the Terms and Conditions: As part of the application process, all prospective applicants must accept the terms and conditions set forth by the Hustler Fund. It is crucial to carefully read and understand these terms before agreeing to them. Acceptance of the terms is necessary for loan consideration.

- Minimum 90-Day Simcard Usage: To ensure eligibility, the sim card used for loan application must have been actively in use for at least 90 days prior to the loan application date. This requirement helps establish a track record of communication and mobile money account usage.

- Provide Residence Location During Onboarding (If Applicable): During the onboarding process, applicants may be required to provide their current residential address or location. This information is essential for administrative and communication purposes. Make sure to provide accurate details if requested.

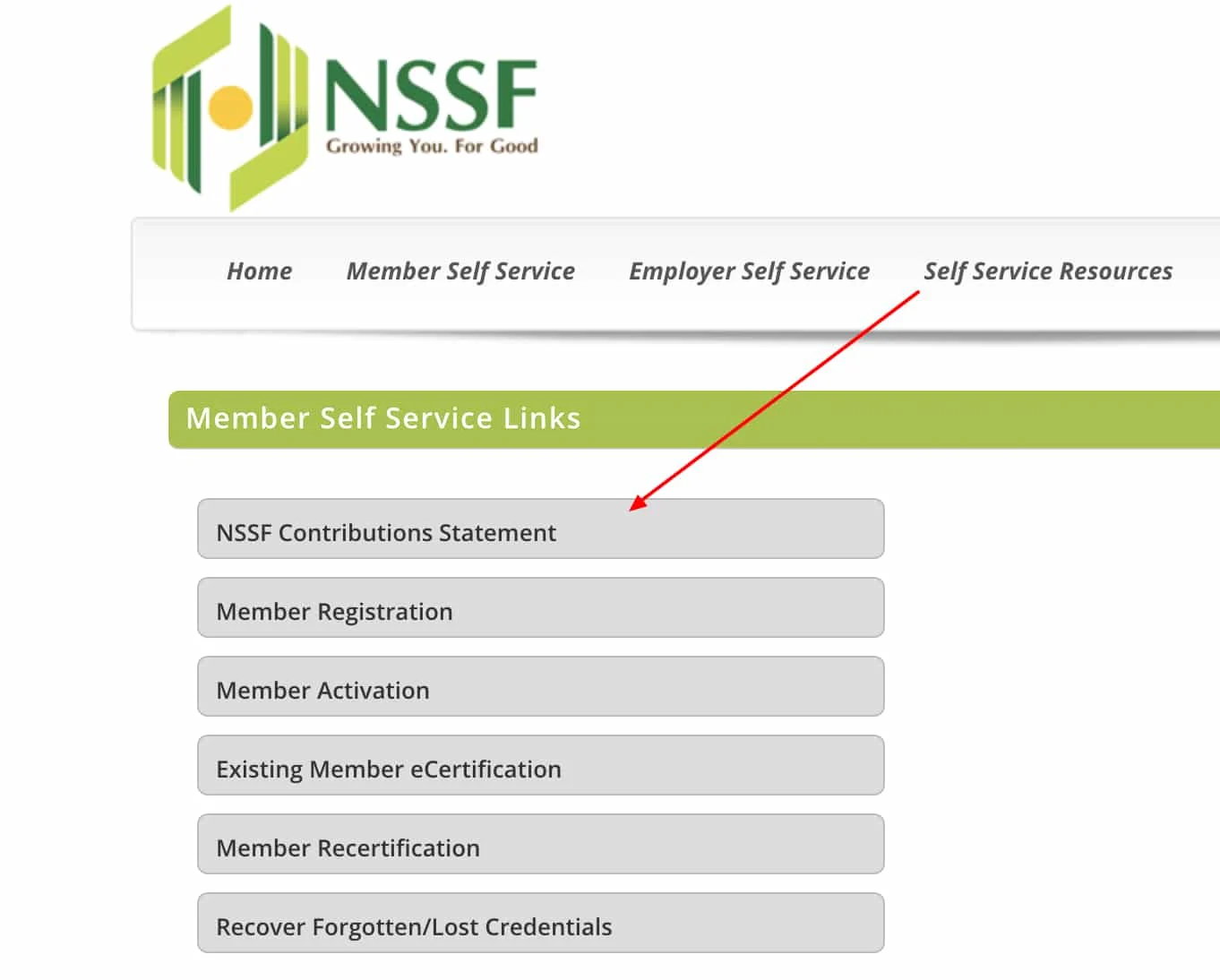

Are you looking to register for a loan with the Hustler Fund? In this step-by-step guide, we will walk you through the process of applying for a loan using the Hustler Fund USSD code. Follow these simple instructions to complete your registration conveniently and efficiently.

Steps to Access Hustler Fund via USSD

Step 1: Dial *544#

on Your Mobile Phone To kickstart your loan registration process, grab your mobile phone and dial *544#, the official USSD code for the Hustler Fund. This code can be dialed on Safaricom, Telkom, or Airtel networks. Ensure you have sufficient credit or airtime before proceeding to the next step.

Step 2: Select the “Register”

Option Upon dialing the USSD code, you will be presented with a menu. Choose the “Register” option, which is typically the first option listed. If you want more information about the loan or wish to review the terms and conditions, you can explore the additional options available.

Step 3: Accept the Terms and Conditions

As a prospective loan applicant, it is mandatory to accept the terms and conditions of the loan. Take a moment to read through the terms carefully. Once you agree to the terms, your information will be shared with the loan providers, ensuring compliance and facilitating a smooth loan application process.

Step 4: Enter Your M-Pesa PIN

Since the loan amount will be deposited directly into your M-Pesa wallet, you will need to input your M-Pesa Personal Identification Number (PIN). This step authorizes the deposit of the loan into your M-Pesa account for easy access and utilization.

Step 5: Loan Registration Confirmation

After completing the previous steps, you will receive a loan registration confirmation message within two hours. This message serves as a confirmation of your successful loan registration. Keep an eye on your mobile phone for this important notification.

Understanding Borrowing and Default Scenarios with the Hustler Fund

Borrowing from the Hustler Fund comes with certain procedures and consequences. This article outlines what happens when you borrow from the Hustler Fund and what occurs in the event of default. Understanding these processes can help you make informed decisions and manage your loan effectively.

What Happens When You Borrow from the Hustler Fund?

- Loan Disbursement: Once your loan is approved, the funds are sent directly to your mobile money account. The Hustler Fund deposits 95% of the approved loan amount into your money wallet, while the remaining 5% is deposited into your savings account scheme within the Hustler Fund.

- Split of Savings Account: The 5% deposited into your savings account scheme is further divided into two categories. 70% of this amount goes towards long-term savings, which can be utilized as a pension fund. The remaining 30% is allocated to short-term savings, providing you with a separate savings pool.

What Happens if You Default on the Hustler Fund?

- Initial Grace Period: In the event that you are unable to repay the loan within 14 days of the due date, your credit rating will be affected. It is crucial to fulfill your repayment obligations within this initial grace period to maintain a positive credit history.

- Extended Repayment Period: If you fail to repay the loan within the initial 14-day grace period, an additional 15 days are provided for repayment. However, during this extended period, the interest rate on the loan rises to 9.5% per year.

- Consequences of Prolonged Default: After more than 30 days of default, you will lose all the credit scores accumulated within the Hustler Fund. Additionally, your Hustler Fund account will be frozen, restricting further borrowing until the loan is fully repaid.

- No Impact on Credit Rating with Other Creditors: It’s important to note that defaulting on the Hustler Fund does not affect your credit rating with other creditors, as the Hustler Fund does not share information with credit reference bureaus (CRB). However, the consequences within the Hustler Fund system will still apply.

- Repayment Options: If you default on the loan, you have the opportunity to repay the outstanding amount in full or in installments. Once the loan is fully repaid, you can resume borrowing from the Hustler Fund.

FAQs

What is the USSD code to apply for the Hustler Fund on my mobile phone?

To apply for the Hustler Fund using USSD, dial *XYZ# (replace XYZ with the actual USSD code provided by the fund management).

Can anyone apply for the Hustler Fund using USSD?

Yes, as long as you meet the eligibility criteria set by the fund, you can apply using the USSD code from any mobile phone.

What information do I need to provide when applying through USSD?

Typically, you’ll be asked to provide personal details such as your name, phone number, location, and sometimes financial information depending on the fund’s requirements.

How do I know if my application through USSD was successful?

After completing the USSD application, you’ll receive a confirmation message on your phone indicating whether your application was successful or not. If successful, further instructions on the next steps will be provided.

Conclusion

When borrowing from the Hustler Fund, the approved loan amount is deposited into your mobile money account, with a portion allocated to a savings account scheme. Defaulting on the loan can have consequences such as affecting your credit rating within the Hustler Fund system and freezing your account. However, this default does not impact your credit rating with other creditors. It’s crucial to repay the loan within the specified grace period to avoid these repercussions. If you default, you have the option to repay the loan in full or in installments before resuming borrowing from the Hustler Fund.