Sponsored Links

MarketMoni is a one-of-a-kind program in recent Nigerian history. Microenterprises comprising market women and merchants, ambitious adolescents, craftsmen, and agricultural workers are eligible for interest–free loans under the program.

This post will walk you through MarketMoni Loan, how to apply for MarketMoni Loan, the conditions, and many more fascinating connected solutions.

How MarketMoni Loan of Federal Government Works

The majority of loan applicants will be perplexed by the Federal Government’s social intervention program and will frequently inquire, “Is this real or fake?“ However, I can promise you that the program is legitimate, as many recipients have attested.

Furthermore, lucky candidates will receive six-month loans ranging from N10,000 to N100,000 per application. There is no interest on the loan except for a one-time 5% administrative charge that you must pay.

Over 24,000 Nigerians have profited from MarketMoni thus far.

The Federal Government’s MarketMoni Loan has been operating in thirteen (13) Nigerian states: Oyo, Ondo, Osun, Abuja, Akwa Ibom, Adamawa, Delta, Ekiti, Kwara, Kogi, Niger, Ogun, and Lagos, and has recently been expanded to plateau, Jigawa, and Kebbi.

MarketMoni Requirements for MarketMoni Loan Application

- A valid BVN is required (Bank Verification Number)

- You must be a member of a market organization, cooperative group, or trade organization that is recognized and accredited.

- Before you apply for a loan, your market association, cooperative, or trade organization must designate you and agree to act as your guarantor.

- Your market association, cooperative, or trade organization must be registered with BOI in order to get a MarketMoni loan (Bank of Industry)

- Before you may be approved for a loan, you must have a physical business location that MarketMoni representatives will verify.

How to Apply for MarketMoni Loan Application 2024

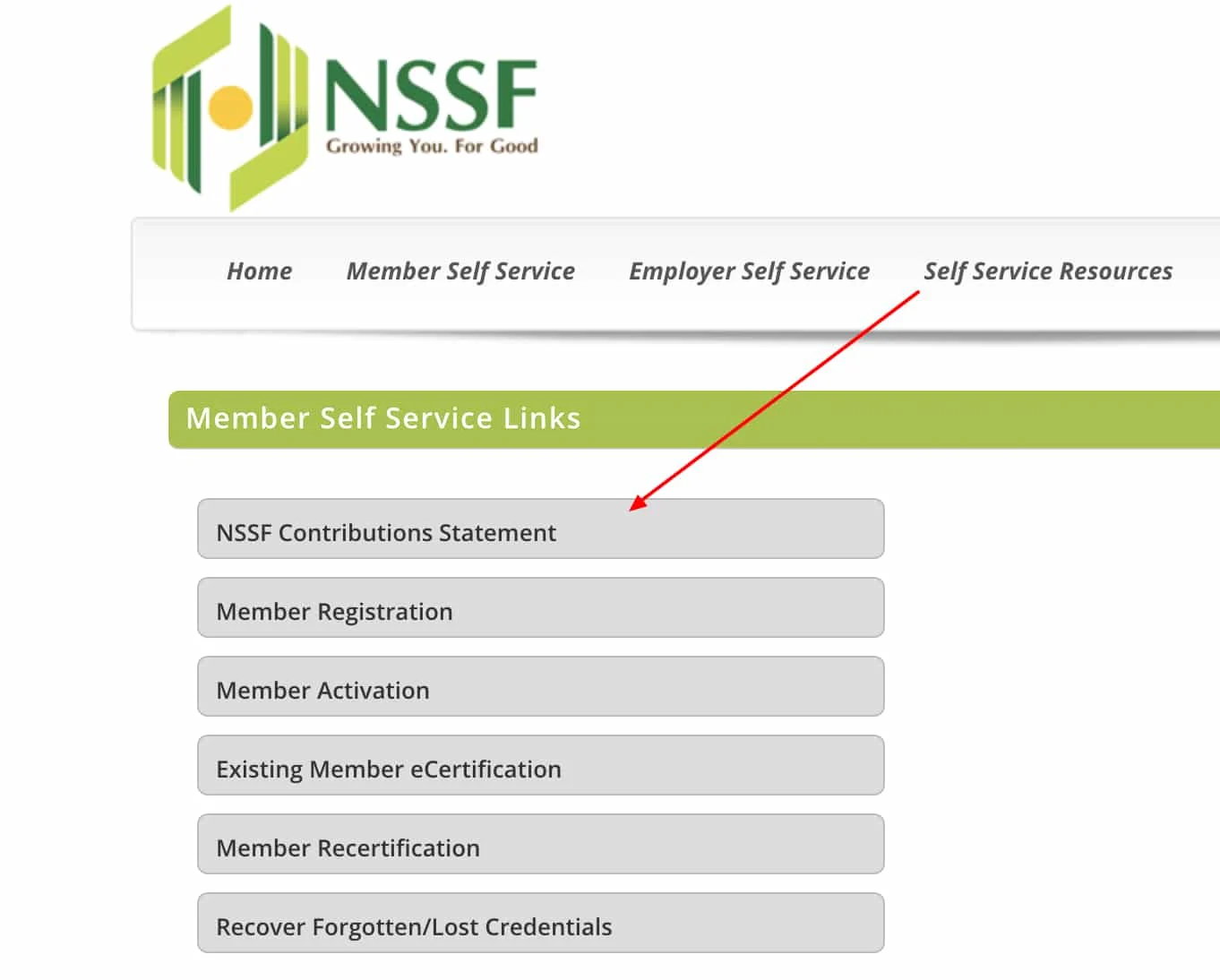

To apply for the loan, you must first obtain a valid BVN number from a Nigerian bank, then follow the steps outlined below.

- Fill out an application at https://apply.marketmoni.com.ng/.

- The MOU Template may be downloaded (one per cooperative)

- To supply your members’ information, download the Excel Sheet (one per cooperative).

- Fill in the blanks on the MOU template and the Excel file with the correct information.

- Return to this page and submit your Memorandum of Understanding and Excel file.

FAQs

What is the MarketMoni Loan Application Form Portal 2024?

The MarketMoni Loan Application Form Portal 2024 is an online platform designed to facilitate the application process for MarketMoni loans. MarketMoni is a government-backed microcredit scheme aimed at providing financial assistance to small and medium-sized enterprises (SMEs) in Nigeria. The portal allows applicants to submit their loan applications, track their application status, and receive updates and notifications regarding their loan processing.

How do I apply for a MarketMoni loan through the 2024 portal?

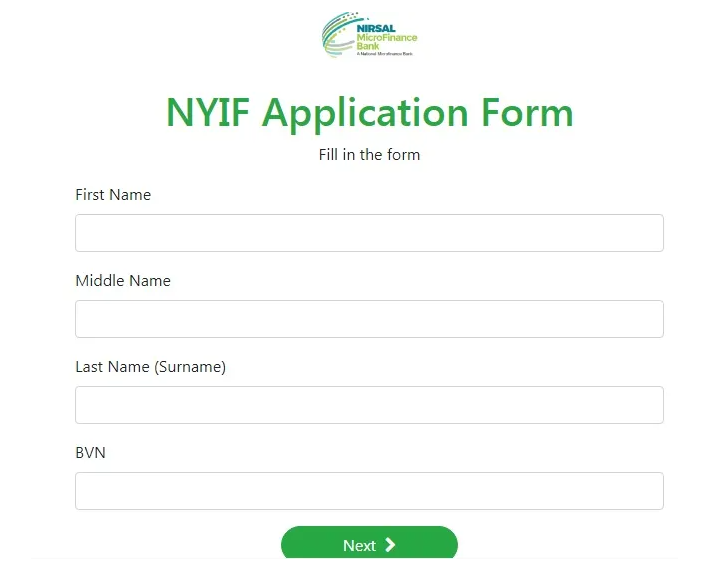

To apply for a MarketMoni loan through the 2024 portal, follow these steps:

- Visit the official MarketMoni Loan Application Form Portal 2024.

- Register by creating an account with your personal details, including your name, email address, and phone number.

- Log in to your account and fill out the loan application form with accurate information about your business and financial needs.

- Upload the required documents, such as a valid ID, business registration documents, and bank statements.

- Review your application and submit it.

- You will receive a confirmation email once your application is successfully submitted.

What are the eligibility criteria for applying for a MarketMoni loan in 2024?

To be eligible for a MarketMoni loan in 2024, applicants must meet the following criteria:

- Be a Nigerian citizen or legal resident.

- Own a small or medium-sized enterprise (SME) that is registered with the Corporate Affairs Commission (CAC).

- Have a verifiable and active business location.

- Possess a valid means of identification (e.g., National ID card, Voter’s card, International passport).

- Provide recent bank statements to demonstrate financial transactions and capacity for loan repayment.

- Be a member of an accredited market association, cooperative, or trade group.

How long does it take to process a MarketMoni loan application through the portal, and when will I receive the funds if approved?

The processing time for a MarketMoni loan application through the portal typically varies depending on the completeness and accuracy of the submitted information. Generally, it takes between 2 to 4 weeks for the application to be reviewed and processed. Once your application is approved, you will be notified via email or SMS. The funds are usually disbursed to your provided bank account within 5 to 7 business days after approval. For the latest updates and precise timelines, applicants are advised to regularly check their application status on the portal.

Sponsored Links