2024 SMEDAN BOA Matching Fund Loan Application Portal | www.smedan.gov.ng

We are happy to inform applicants who are interested in participating in the SMEDAN BOA Matching Fund Program should read this application instruction carefully before proceeding to the next round of registration. The start date for the next registration is uncertain at this time, however, we will provide additional information in this article.

Would you wish to apply for a loan from SMEDAN Boa in 2024? Many people would like to join the SMEDAN Matching Fund program, and this article will explain how to find out when the application form is available, as well as how to fill out and submit the application form.

- NYIF Loan Application Form

- Farmer Moni Loan Application Form

- Trader Moni Loan Registration

- Survival Fund Registration

All You Need to Know About SMEDAN BOA Loan

The SMEDAN Small and Medium Scale Enterprises Development Agency of Nigeria and the Bank of Agriculture are both interested in building synergy in key areas of their mandates and the output is the Matching fund programs intervention for MSEs across the country to boost their output.

The SMEDAN Boa loan is open to small and medium-scale enterprises across the country and they can apply for loans within the range of 1.2 million Naira to 5 million Naira on business-friendly terms. Finally, it is important to note that the portal is active and we would guide you on how to apply for loans.

Requirements for SMEDAN BOA Loan Registration 2024

To be qualified for the 2024 SMEDAN Loan, you need to have the following before filling out the application form.

- The applicant must be a Nigerian citizen

- You must not be less than 18 years of age

- You must have a valid BVN

- Must have an active phone number registered under your name

- Be an active member of any market cooperation union within your location

- Have a valid means of identification

How To Apply For The SMEDAN BOA Loan

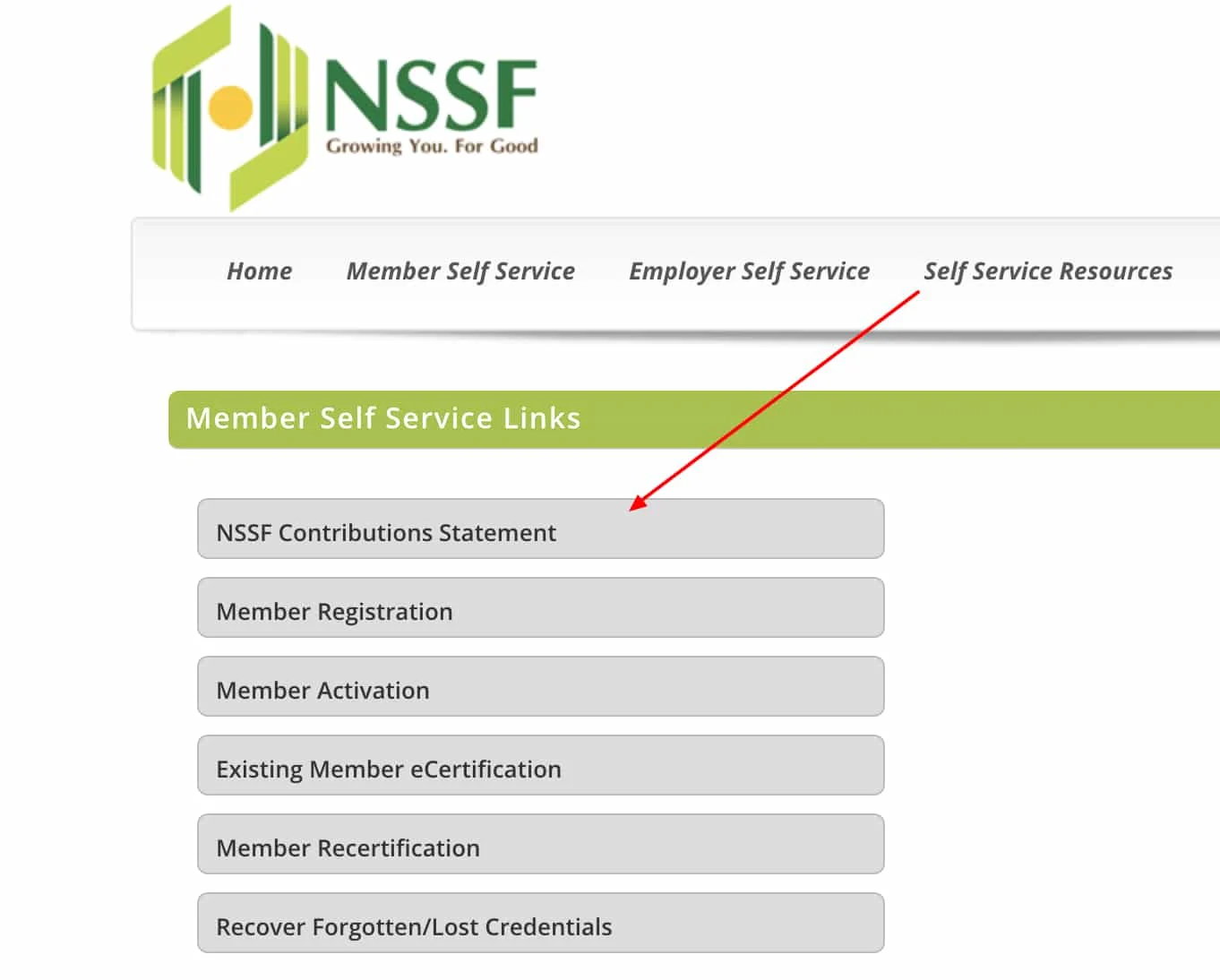

- Application for SMEDAN BOA Loan will be done online via the portal www.smedan.gov.ng and interested applicants should visit the portal and provide the information needed to enable them to access their loans.

- SMEDAN is the ‘Small and Medium Scale Enterprises Development Agency of Nigeria’ whose primary focus is to boost SMEs by providing them with enabling environment and business loans for them to scale their businesses.

SMEDAN Registration Portal

After registering with SMEDAN, all enterprises should visit the SMEDAN recruitment portal at www.simplifiedcredit.net/matching-fund/screening, fill out the form provided on the screen, and then click submit. This can be done using a mobile device or a laptop, so start applying right away if your company is headquartered in any of the states indicated in the preceding section.

www.simplified.net SMEDAN Loan Application Portal Login

The application portal for the SMEDAN BOA loan is www.simplified.net, and once there, you will notice menus that will allow you to access your business before applying for the loan. You can take your time and browse the website before applying for a loan. Loans are classified into three types: company loans, personal loans, and intervention funds. There are subcategories of loans within each of these categories that you should investigate before applying for a loan.

FAQs

What is the SMEDAN BOA Matching Fund Loan?

The SMEDAN BOA Matching Fund Loan is a financial assistance program initiated by the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) in collaboration with the Bank of Agriculture (BOA). It aims to provide funding support to small and medium-sized enterprises (SMEs) in Nigeria by matching the contributions made by both SMEDAN and BOA, thereby increasing the accessibility of affordable loans to eligible businesses.

Who is eligible to apply for the SMEDAN BOA Matching Fund Loan?

Eligible applicants for the SMEDAN BOA Matching Fund Loan include registered small and medium-sized enterprises (SMEs) operating in various sectors of the Nigerian economy. To qualify, businesses must meet certain criteria, including legal registration, compliance with regulatory requirements, and demonstration of viable business plans and prospects for growth. Additionally, applicants must adhere to specific guidelines outlined by SMEDAN and BOA regarding loan utilization and repayment.

How can I apply for the SMEDAN BOA Matching Fund Loan?

To apply for the SMEDAN BOA Matching Fund Loan, interested SMEs must access the designated loan application portal provided by SMEDAN. The application process typically involves completing an online application form, providing relevant documentation to support the business’s eligibility and financial standing, and submitting the application for review. It is essential to thoroughly understand and adhere to the application guidelines and requirements outlined by SMEDAN and BOA to increase the chances of a successful application.

What are the benefits of the SMEDAN BOA Matching Fund Loan?

The SMEDAN BOA Matching Fund Loan offers several benefits to eligible SMEs, including access to affordable financing with favorable terms and conditions. By leveraging the matching fund mechanism between SMEDAN and BOA, businesses can obtain loans at lower interest rates and flexible repayment schedules, thereby easing the financial burden associated with business expansion, capacity building, and operational enhancements. Additionally, the loan program may provide opportunities for SMEs to access technical support, training, and mentorship to enhance their business performance and sustainability.