NYIF Loan Application Form Portal 2024 | See How To Apply For NYIF Program

We are glad to inform you that the National Youth Investment Fund has currently opened its application portal for applicants to fill out the application form at the NYIF Loan Application Form Portal. Read below as we will show you recruitment and how you can successfully apply for the loan.

Have you heard about the current NYIF program or are you interested in applying? If you answered yes, you’ve come to the right place because, in this post, we’ll show you the latest information about the NYIF Loan portal, See how to access the NYIF application form below.

All You Need to Know About NYIF Loan

The National Youth Investment Fund, or NYIF, was introduced in October and is supported by the Federal Ministry of Youth and Sports Development to help young people across the country. Finally, between 2022 and 2024, the NYIF program aims to financially empower Nigerian youngsters to create at least 500,000 jobs.

The National Youth Investment Fund Program is primarily for youths who own registered or unregistered businesses; however, those who own unregistered businesses must meet the requirements listed below, and those who own registered businesses must meet the requirements that every registered business in Nigeria must meet.

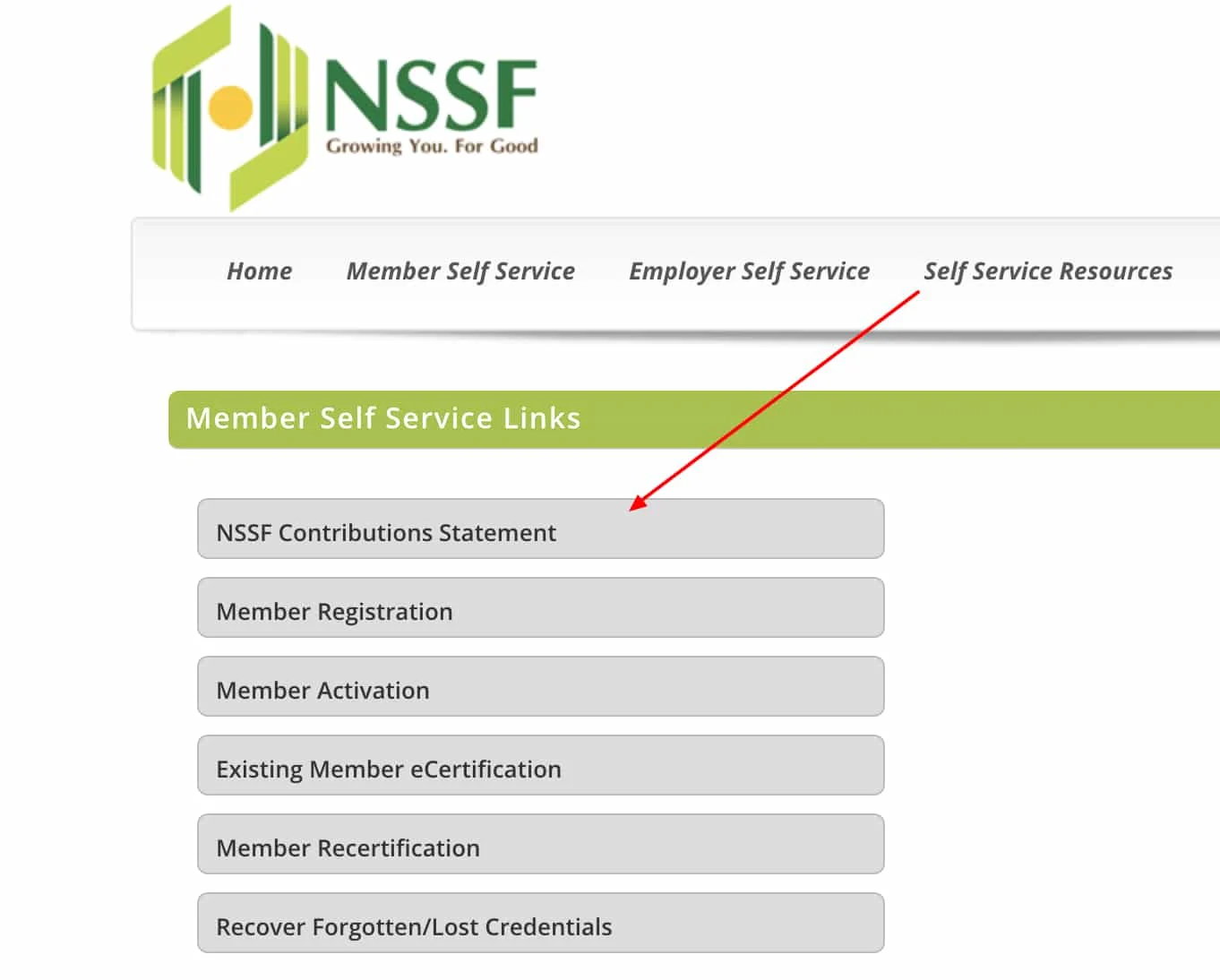

The online portal www.nmfb.com.ng is where you can apply for a loan from the National Youth Invest Fund, and the application form will be available after the recruiting start date is announced. Applicants should go to the recruiting portal as soon as the starting date is published and follow the instructions specified in this article to apply.

Requirements For NYIF Loan Application 2024

Individuals, non-registered enterprises, and registered firms in the country are all eligible to participate in the NYIF program. Because the qualifications for both categories differ, it is critical that you thoroughly examine the requirements for the category to which you are applying.

Requirements For Registered Businesses

The following are the requirements for registered businesses:

- Formal business enterprises (Youth owned enterprises), duly registered with the Corporate Affairs Commission (CAC).

- Business plan Summary or Completed Questionnaire.

- Valid Bank Verification Numbers (BVNs) of Directors

- Provision of Tax Identification Number (TIN).

- Entrepreneurship Training Certification from FMYSD EDIs

Requirements For Individuals/Non-Registered Businesses

The NYIF program is a federal government-sponsored empowerment initiative, however, not everyone is eligible to participate. Individuals and non-registered businesses must meet the following requirements in order to register for the empowerment program:

- Applicants are expected to be a citizen of Nigeria.

- Must be between 28 and 35 years of age.

- An active email address and also phone number.

- Your BVN and Bank Account Number.

- A CAC Registered business.

How To Apply For NYIF Programme

Applicants should go to the NYIF recruitment portal at www.nyif.nmfb.com.ng to apply/register, but keep in mind that you will need to create an account first. Finally, if you have any problems registering, please let us know in the comments section below or send us an email, and we will get back to you.

How To Check NYIF Loan Status

Numerous applicants have been searching for ways to find out the status of their loans. To check the status of your loan, follow the steps below:

- Visit the NYIF application portal nyif.nmfb.com.ng

- Input your details and log into your account

- Click on the Check Loan status box

- Your Lon status will be displayed on the screen

Applicants can now begin checking their loan status on the portal immediately after applying for the NYIF program. The goal of verifying the loan status is to determine if you are qualified to get the loan as soon as the government begins delivering loans to people who were chosen to be beneficiaries.

FAQs

What is the NYIF Loan Program for 2024?

The NYIF (Nigeria Youth Investment Fund) is a government initiative aimed at empowering Nigerian youths through financial support for entrepreneurship and business development. The program provides loans, training, and mentorship to eligible young individuals looking to start or expand their businesses.

How do I access the NYIF Loan Application Form Portal for 2024?

To access the NYIF Loan Application Form Portal for 2024, visit the official website designated for the program. Ensure you’re using a secure internet connection, then navigate to the application section. From there, you can fill out the necessary information and submit your application.

What are the eligibility criteria for the NYIF Loan Program in 2024?

Eligibility for the NYIF Loan Program in 2024 typically includes being a Nigerian youth between the ages of 18 and 35, having a viable business idea or existing business, being a registered business owner with the Corporate Affairs Commission (CAC), and meeting other specified criteria outlined by the program.

What documents are required for the NYIF Loan Application in 2024?

While specific document requirements may vary, common documents typically include a valid means of identification (such as a National ID card, driver’s license, or international passport), BVN (Bank Verification Number), business registration documents from the CAC, a business plan, and any other supporting documents requested by the NYIF program. Be sure to review the application guidelines carefully to ensure you have all necessary documents before applying

Conclusion

Applicants ought to be aware that NYIF recruiting is also free of charge; documents will be scanned and uploaded to the recruitment portal at the end of the process; the presence of the documents listed above is extremely important and required. If there is any additional information that candidates should be aware of prior to the release of the NYI Recruitment application form, we will notify you via this page, which will be updated often with the most recent information on the NYIF loan application.